Fueling the future

The transition from gas to battery-powered equipment in landscaping

By Ryan O’Connor

As gas-powered equipment usage dwindles in Canada, industry members weigh in to paint a picture of the current landscape.

The landscaping industry, like many others, has seen significant advancements in recent years, with one of the most notable changes being the shift away from gasoline-powered equipment. Battery and electric alternatives are becoming increasingly attractive to consumers, driven by the demand for more efficient, sustainable options and growing regulatory pressures around environmental and noise concerns. As a result, many Canadians are beginning to move away from gas-powered tools.

Still, some landscapers remain reliant on gas equipment, either due to hesitancy or the limitations of current alternatives. But with rapid technological progress and a growing dedication to sustainability, the noise and fumes of gas-powered tools may soon become a thing of the past in an industry committed to a greener future.

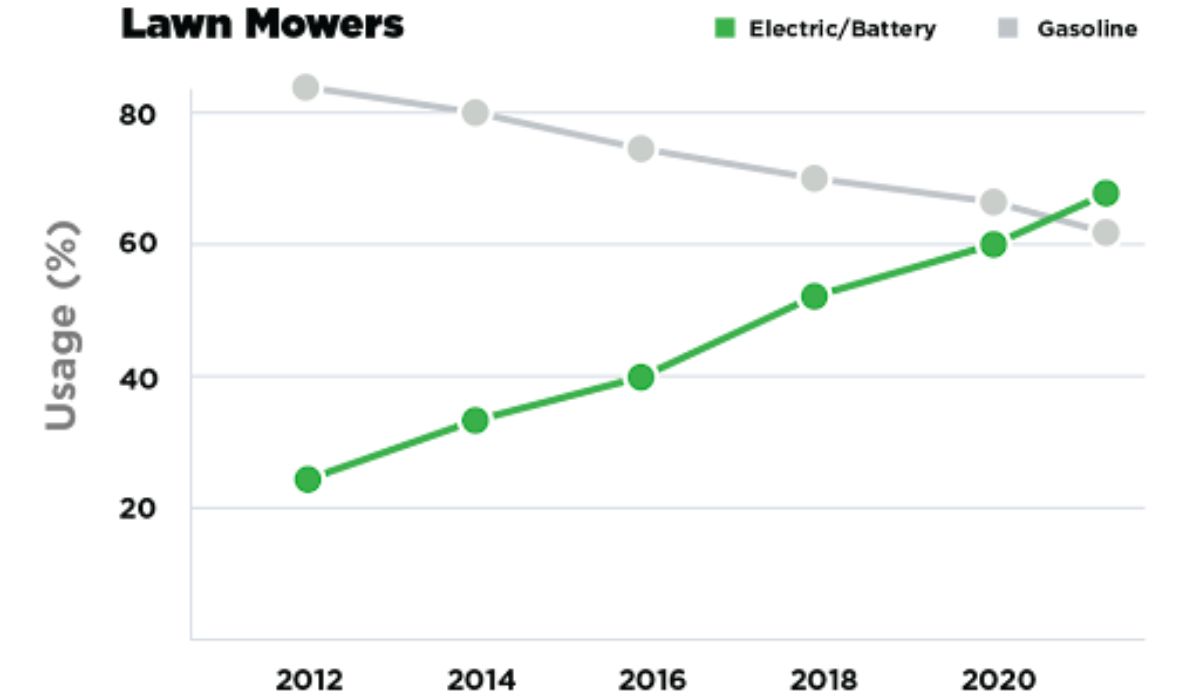

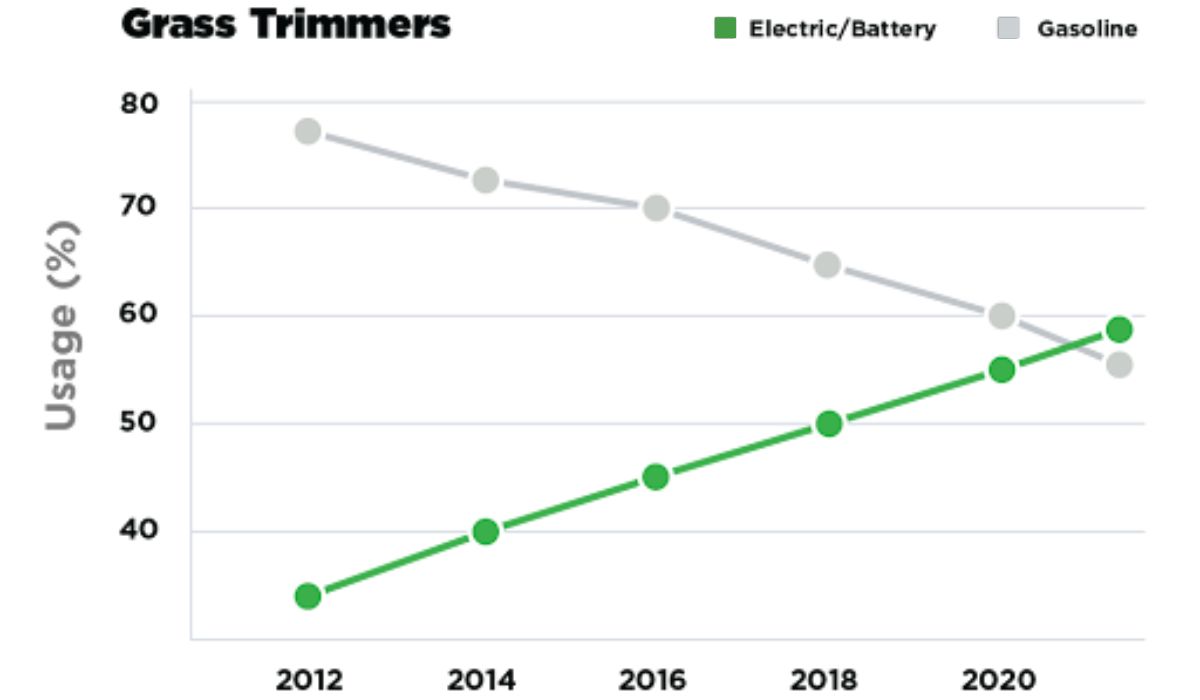

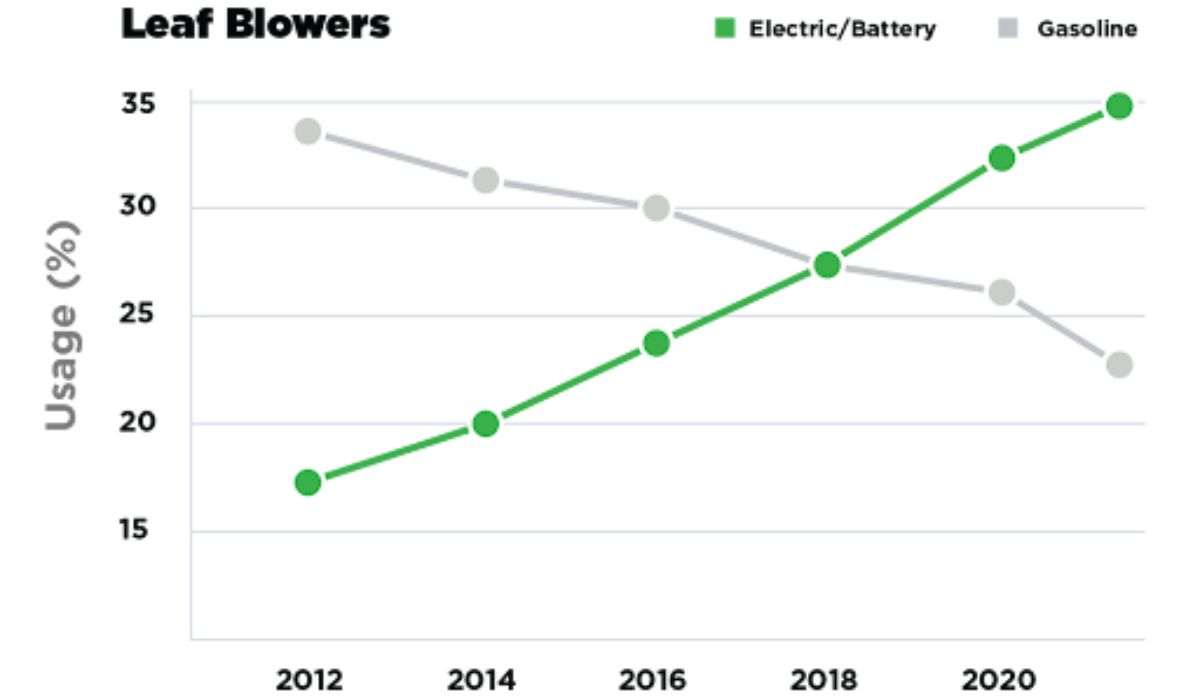

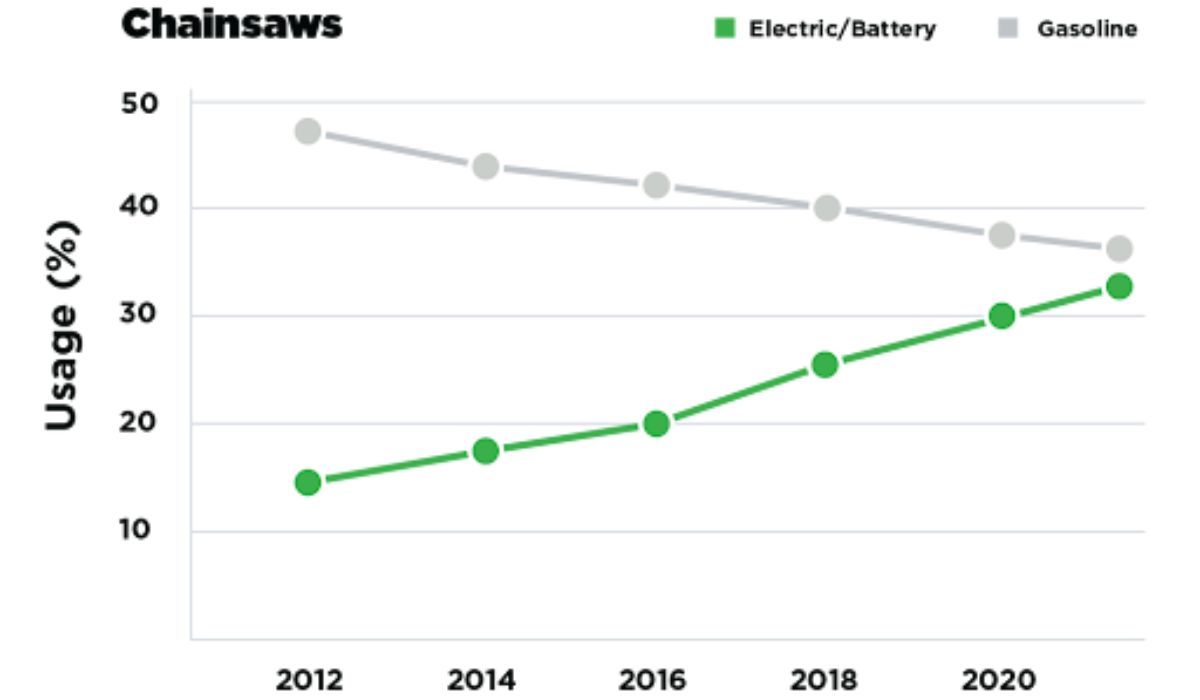

Lawn Care and Landscaping Equipment Consumer Trends in Canada (2012 - 2021) |

|

|

|

|

|

| Consumer trends in Canada show that despite gas equipment’s previous industry dominance, alternatives have already surged ahead in popularity in the last decade. (StatsCan) | |

Charging up to take on the job

Since their introduction in the mid-20th century, battery-powered equipment has evolved to become the dominant force in the sales of lawn care and landscaping equipment worldwide. Initial reception was shaky and slow to adopt, with the first battery- powered tools by Black & Decker failing to win over the industry immediately. Over time, technological advancements such as the integration of lithium-ion batteries have led to their current wider adoption among consumers.

In Canada, there has been an increase in nearly every type of battery-powered landscaping equipment from 2011 to 2021, with tools such as trimmers and chainsaws seeing a 10 per cent increase in ownership over that time. Over the same period, gas-powered equipment has experienced decreased sales in all equipment categories.

During this crucial span, battery-powered equipment quickly established itself as the dominant force in tools alongside electric. Many landscapers, including Gabrielle McCullough-Murray, a landscaper based out of Toronto, believe they are simply the faster and more convenient choice.

“About two years ago, our company started getting some battery equipment in for certain clients, and last year we started to make a significant shift for battery equipment,” says McCullough-Murray. “For certain equipment we’re fully switched to battery, but we’re not fully there yet.”

McCullough-Murray notes that the superior convenience of battery-powered equipment has made it the preferred choice for her company, allowing tasks to be completed more quickly compared to gas-powered tools. “The gas ones can be so finicky, and way less ‘all conditions’ on the work site in my experience,” says McCullough-Murray. “With batteries you're not messing around trying to get it to start or having issues with the parts. You also don't have to leave it on idle. It's just always ready, good to go.”

Landscaping companies that have made the switch to battery-powered equipment appreciate the savings on fuel and the reduced need for stocking replacement parts. Since batteries are a one-time purchase, the ongoing expense of fuel is eliminated, which is critical for large-scale operations that prioritize speed and efficiency.

According to Consumer Reports, after the initial purchase, the annual maintenance costs of battery- powered or electric equipment are consistently lower than those of gas-powered tools, factoring in refuelling and repair expenses. In addition to convenience and cost savings, customers will enjoy the reduced noise and emission levels from a battery.

A webinar hosted by landscaping equipment supplier Toro detailed the benefits of transitioning to a battery-powered fleet and key factors landscapers should consider. Paul McCallum, Toro's regional sales manager for Canada, discussed how the company

is actively prioritizing the production of battery equipment to match consumer trends.

“Now, less than five per cent of commercial landscape businesses are still fully gas while the battery keeps growing in popularity,” says McCallum. “A lot of it comes down to personal preference, also. Some people will go electric because they have a Tesla at home, for instance.”

“But there’s certainly people on the cusp of innovation in the [battery] industry, and it’s only becoming a more popular choice.”

Chugging along or petering out?

Despite a significant decline in the sales of gas-powered equipment in Canada in recent years, gasoline products continue to dominate the market, particularly with power-intensive equipment like chainsaws and snow blowers. While there are drawbacks, such as fumes and other inconveniences, batteries have yet to match the energy efficiency of gas-powered options.

Gas offers a far more energy-dense option compared to alternatives, achieving 34.6 MJ per litre compared to just 0.4 MJ per litre for a lithium-ion battery pack. In practical terms, gas-powered equipment can run much longer than batteries on the same amount of juice, offering more energy efficiency and endurance for high- intensity tasks.

Although McCullough-Murray is a proponent of the shift away from gasoline, she admits the technology is not yet there for switching specific equipment, such as industrial leaf blowers. That extra power from gas allows her to sweep through jobs that battery- powered equipment just can’t keep up with.

“For fall and spring cleanups, we absolutely need the gas backpack blowers, which I know is the biggest complaint from neighbours and residents,” says McCullough-Murray. “They're loud and they're obnoxious. But when you have so many properties to get through and they need to be meticulously cleaned, you're going to run through your batteries way too fast and have to keep switching them out.”

A key component of the shift toward battery and electric equipment is advertising. As companies track consumer preferences for gas alternatives, they have slowed their promotion of gas- powered products accordingly. The growing demand for battery and electric-powered tools increases their publicity, further accelerating the transition away from gas.

Despite this, gas has a sustained grasp on the landscaping vehicle market, with numerous manufacturers of bulldozers and forklifts exclusively offering gas machines at a cheaper price. Companies like CAT have introduced electric alternatives to their fleets, including the D6 XE, which is marketed as the world's first high-drive electric dozer.

Despite this milestone, it will likely take longer for manufacturers to develop and stabilize the pricing of these vehicles, as they require significantly more power. Until then, gas can enjoy its hold over the vehicular industry.

Electric: A surging competitor

Electric-powered landscaping equipment is emerging as the biggest competitor to gas-powered manufacturers, seeing an even more dramatic spike in popularity than battery equipment. As advancements in electric equipment close the power gap between gas and electric tools, consumers are finding even fewer reasons to purchase gas-powered options.

Ryan Johnson is the owner of Mountview Landscaping, based out of Paris, Ont. He views electric equipment as an appealing option for future purchases for his company, which offers services such as property maintenance and snow and ice removal. While Johnson says that gas equipment is an essential product in daily operations, he sees a future where his fleet goes gas-free.

“At the moment, most of our fleet is gas, about 30 per cent is either electric or battery,” says Johnson. “I unfortunately feel a lot of my electric equipment lacks an easy fix for when things do go south. It has disrupted entire work days at the company.”

In the past, electric fleets were unable to match the power of their gas-powered counterparts, such as the higher RPM of gas trimmers or the CFM of gas leaf blowers. Yet, similar to battery-powered equipment, electric tools have seen significant advancements and investment, greatly improving their reliability and performance. And, despite being generally harder to fix, Johnson says the overall reliability is still superior over gas equipment.

“It is absolutely more reliable than gas, in my experience,” says Johnson. “The electric portion of my fleet is practically silent and avoids most of the hassles involved with gas. It has a lot of the same advantages that my battery equipment does.”

Electric landscaping equipment is continuing to gain momentum as technological advancements continue to improve year after year. This growth is likely to sustain, especially with strong support from governments worldwide, many of which are striving to reduce emissions and endorse greener alternatives.

|

| A quick Google search will yield petitions from multiple Canadian cities calling for the phasing out of gas leaf blowers. (Google) |

Regulatory pressures and environmental concerns

Discussions around landscape equipment have shifted beyond personal preference in recent years, as various governments have implemented bans on gas-powered tools, accelerating the already hasty shift away from gas equipment in Canada.

Vancouver, London and Oakville are all among Canadian cities that have considered a gas-powered landscaping equipment ban, with environmental and residential concerns at the forefront of these discussions. Vancouver is currently working towards a ban on personal and residential gas-powered landscaping equipment to help reach the nation’s goal of net-zero emissions by 2050. City officials say they plan to discuss the possibility of a phase-out with staff this year.

Metro Vancouver’s division manager of air quality bylaw and regulation development cited the equipment can ‘definitely have impacts’ on the health of the workers and people around the equipment as well. For context, a typical 3.5 hp gas mower can emit the same amount of greenhouse gases in an hour as a new car driven 550 km, which is approximately the distance from Toronto to Montréal. Electric or battery mowers, which are much quieter and becoming as cheap as gas alternatives, do not have the same problem.

Dave Stewart recently spoke in favour of battery equipment in a panel discussion held at Landscape Ontario, a provincial trade association headquartered in Milton, Ont. Stewart is the business development manager at Makita, a Japanese manufacturer of power tools with operations in Canada. He mentions how the company has placed enough faith in current industry and environmental trends that it has gone fully cordless.

“Makita were always known for the four-stroke gas engine,” says Stewart. “We decided to stop making those, to some consumer outcry, and we just went straight cordless. We had already been making battery tools for over 50 years by the time we made that decision, so we had a head start.”

Another major motivation for municipalities to enforce these regulations is noise pollution. Gas- powered leaf blowers, for instance, are much louder than alternatives, reaching noise levels of up to 105 db (comparable to a table saw) as opposed to 65 db for battery models. Neighbourhood residents consider the early-morning racket caused by these machines as intrusive to their peace, but as noted by Gabrielle McCullough-Murray, the technology for battery and electric alternatives is still lacking on large-scale jobs.

Canadians pushing for restrictions on gas- powered equipment could hope to mimic California's 2024 statewide ban on the sale of gas-powered lawn and garden tools. The ban encompassed small-engine equipment like leaf blowers and lawn mowers, while offering $30 million USD in state rebates to homeowners and landscapers.

With a population and economy comparable to California, Canada could look to California’s approach as a model for advancing its own net-zero goals. In the meantime, the ongoing shift toward alternative equipment may signal the beginning of a greener and quieter future for the landscaping industry.